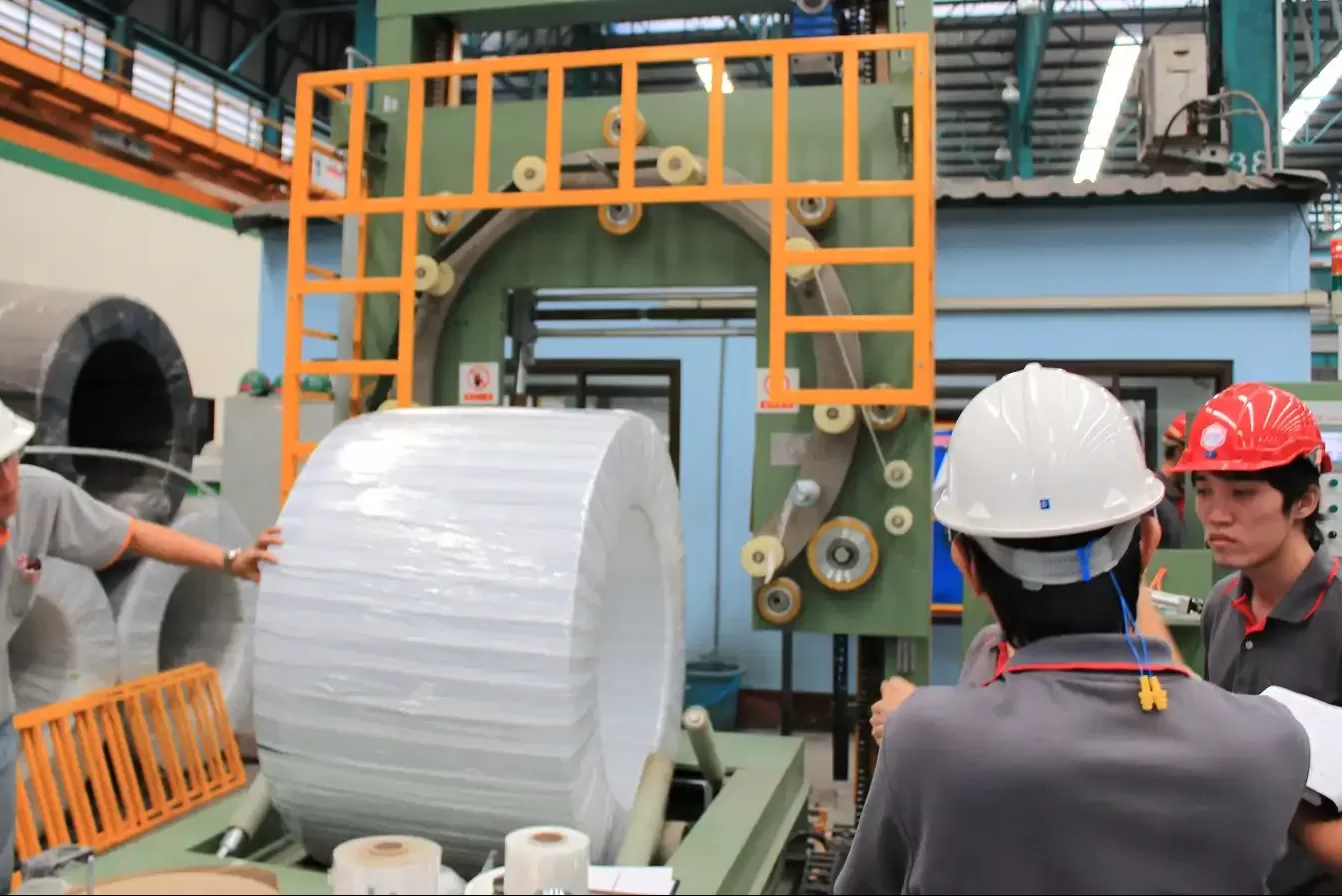

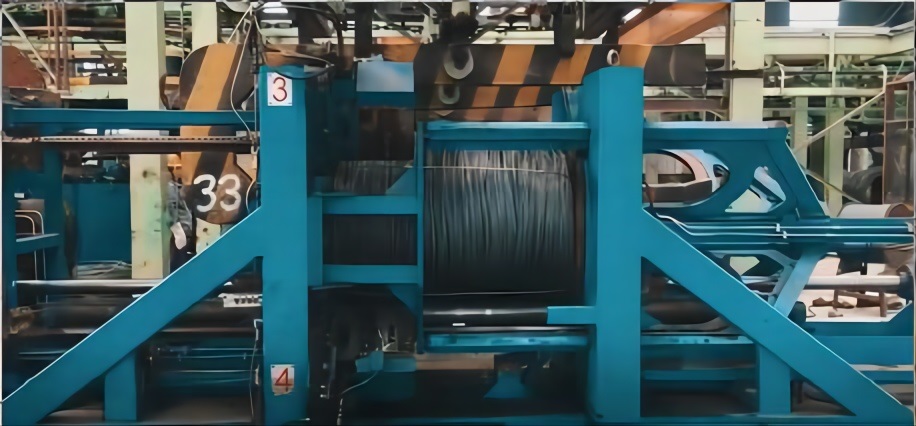

In the world of manufacturing, efficiency and cost-effectiveness are paramount. A wire coil wrapping machine can revolutionize production lines by offering increased productivity and reduced labor costs. However, before diving into such an investment, understanding the return on investment (ROI) is essential to ensure it aligns with business goals.

The process of calculating ROI involves assessing various factors, from initial costs to long-term savings. Companies must weigh these elements against potential gains to make informed decisions. By examining these details closely, businesses can better determine whether the purchase will yield the desired financial benefits.

Claim: Calculating the ROI of a wire coil wrapping machine is crucial in making informed investment choices, ensuring optimal resource utilization and maximizing profitability.

What factors influence ROI in wire coil wrapping machines?

Understanding core components

To calculate ROI, it’s essential to understand the primary components that contribute to the investment’s overall value. These include the initial purchase cost, operational efficiency improvements, maintenance expenses, and expected lifespan. Each factor plays a critical role in determining the machine’s financial impact on your operations.

Quantifying savings and efficiency gains

The following table illustrates estimated numerical data for efficiency gains when using a wire coil wrapping machine:

| Factor | Manual Process | Machine Process |

|---|---|---|

| Time per Coil (minutes) | 10 | 5 |

| Labor Cost per Hour ($) | 20 | 15 |

Insights into cost-effectiveness

By examining these numbers, one can discern that a wire coil wrapping machine dramatically cuts down processing time and labor costs. This efficiency not only boosts productivity but also reduces the expense per unit, leading to enhanced profit margins over time.

Diving deeper into operational impact

Operational improvements extend beyond mere time savings. The machine’s precision minimizes material waste, further contributing to cost-effectiveness. Below is a table depicting potential annual savings due to decreased wastage:

| Material Waste (%) | Annual Savings ($) |

|---|---|

| Manual Process: 5% | – |

| Machine Process: 2% | 10,000 |

Two-Fact Statement

True Fact: The average wire coil wrapping machine increases production speed by up to 50%.

False Fact: Maintenance costs typically exceed the initial purchase cost within the first year.

How to strategically assess the ROI?

Contextual introduction

Strategically assessing ROI requires a comprehensive approach, factoring in both tangible and intangible benefits. While numerical data provide a clear picture of direct financial returns, considering other elements such as improved employee efficiency and enhanced product quality is equally vital.

Snippet paragraph

Calculating ROI isn’t just about numbers; it’s about understanding the holistic value a wire coil wrapping machine brings to your business. This includes aspects like employee satisfaction and product consistency, which indirectly bolster company reputation and client trust.

Deeper explanation

Beyond immediate cost savings, long-term strategic benefits may include brand reliability through consistent product packaging and less downtime due to reduced errors. These intangibles can significantly affect customer satisfaction and retention rates, reflecting positively on overall business growth.

Conclusion and actionable takeaways

To conclude, evaluating the ROI of a wire coil wrapping machine involves a multidimensional analysis. Businesses should consider upfront costs, ongoing savings, and broader operational impacts. Here is a summary table of ROI evaluation components:

| Component | Description |

|---|---|

| Initial Investment | Cost of purchasing the machine |

| Efficiency Gain | Reduction in processing time and labor costs |

| Material Savings | Decrease in material wastage |

| Intangible Benefits | Brand reliability and employee efficiency |

Claim: A deliberate evaluation of the ROI for a wire coil wrapping machine ensures informed decision-making, aligning investments with business objectives for sustained growth and profitability.